Inform Financial & Management Reporting

We can assist you with your financial & management reporting, whilst providing sound advice and best practice recommendations to improve your business

In addition to our external and internal audit services, our team has a background in providing accounting and financial reporting advice, as well as bookkeeping and other services as an adjunct to assist our audit clients, or as a separate service for other clients.

As demand for these additional services has grown, our firm has formed a new specialist division, inform, to help manage this demand and increase our service offering. This division operates separately from the audit team, allowing our clients to get a higher level of service focused on their specific requirements.

Some of the key services that can be provided by inform. include:

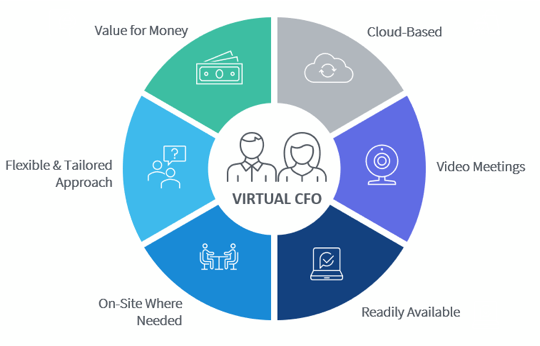

What is our Virtual

CFO service?

The Virtual CFO is a relatively new concept in the accounting industry and has been growing as an option as cloud-based finance packages and digital collaboration tools become more commonplace. The use of a Virtual CFO service is a fantastic way for small and medium businesses to get access to services otherwise offered by a Chief Financial Officer (CFO) for a fraction of the price of employing someone full time in this position. The exact roles and tasks that the Virtual CFO service would complete would be decided through agreement with your team, but as an example this service generally provides:

- Provide regular detailed management reports, which include analysis of key data and trends to aid with decision making and to monitor business performance

- Help implement operational budgets, and include regular reporting of performance against these

- Offer a level of financial insight and assistance with guidance on company decisions and issues

- Liaise with the appointed Tax Agent to ensure all compliance requirements are met

- Provide accounting assistance to undertake general journals, maintain asset register, review reconciliations, and maintain a level of independent oversight over the finance system and transaction data

- Help develop and implement your strategic plan – the “big picture” – in a way which is normally well beyond the scope of roles of existing finance staff in small businesses